Describe How Mortgage-backed Securities Are Used

For example do you. Describe how mortgage-backed securities MBS are used.

:max_bytes(150000):strip_icc()/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

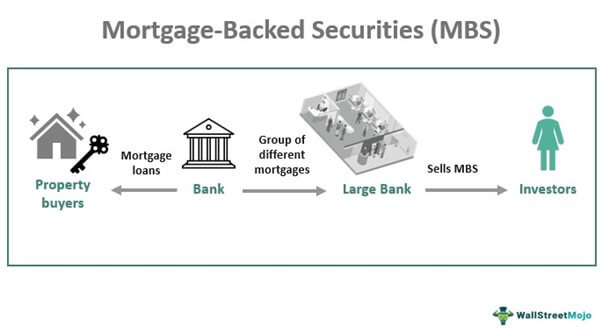

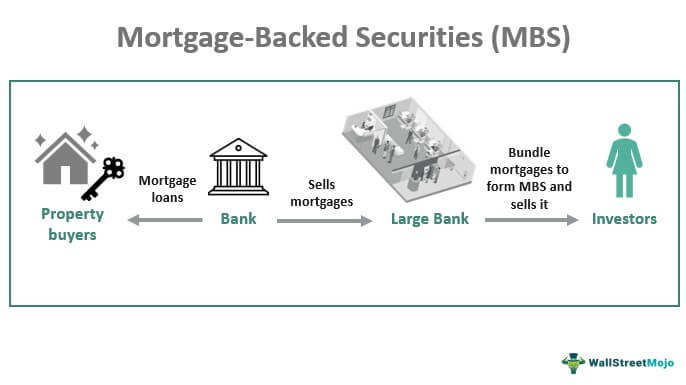

-A financial institution that purchases or originates a portfolio of mortgages can sell mortgages by packaging them and issuing mortgage-backed securities.

:max_bytes(150000):strip_icc()/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

. The mortgage-backed securities are bonds that help us buy a house. Mortgage-backed securities had actually existed for decades. To create asset-backed securities financial institutions pool multiple loans into a single security that is then sold to investors.

Prospectus and Road Show. Those securities are sold to investors as bonds which can be bought and sold any way investors want. A mortgage-backed security MBS is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them.

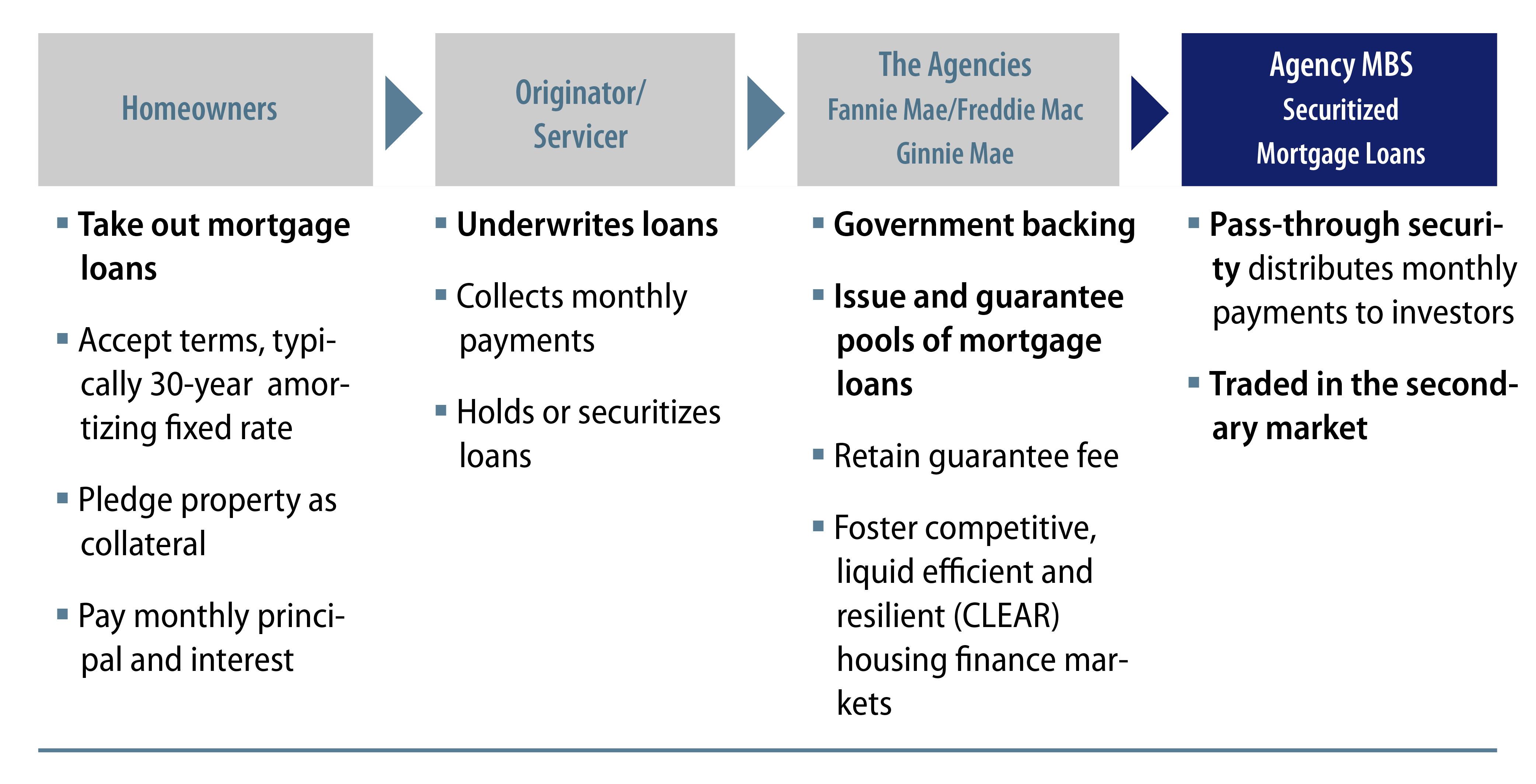

Those mortgage loans are bought from banks and lending institutions and linked together into pools to increase value and reduce risk. 1 those guaranteed by a federal agency Ginnie Mae whose securities are backed by the full faith and credit of the US government 2 those guaranteed by a GSE eg Fannie Mae and Freddie Mac but not by the US government and 3 those issued by private entities that are not. Seven facts reveal a need to change the conventional.

The pools can include many types of loans such as mortgages. In mortgage-backed securities receive monthly payments of interest and principal. Describe how collateralized mortgage obligations CMOs are used and why they have been popular.

Securities with higher coupons offer the potential for greater returns but carry increased credit and prepayment risk meaning the realized yield could be lower than initially expected. They are created when a number of these loans usually with similar characteristics are pooled together. However the data reveal that subprime securities performed rather well.

They are packaged together into pools and then sold as a single security. Explain the rights of common stockholders that are not available to other individuals. In short investors expect to be paid more to take on this added uncertainty.

MBS trading is critical to the health of the mortgage-lending market and is a. Mortgage-backed securities are sometimes used to hedge the overall risk of an investors fixed income portfolio. It can be said that the mortgage market was at the center of the Credit Crisis of 2008.

What are mortgage-backed securities. This is due to negative convexity. Asset-backed securities ABS are securities derived from a pool of underlying assets.

Investors in MBS receive periodic payments. This process is known as securitization. Also known as MBS theyre fixed-income investments backed by a pool of mortgages.

Critics claim that too many securities especially subprime were rated AAA. Mortgage-backed securities called MBS are bonds secured by home and other real estate loans. However if you look at it through a broader spectrum mortgage-backed securities are the reason why your lender can give you a mortgage to buy your dream home.

When a bank lends money to someone to buy a home it sells that loan to an investment bank which bundles a lot of loans with. In their most basic form the mortgagors borrowers monthly payments are passed on to the bondholder ie. Mortgage-backed securities typically offer yields that are higher than government bonds.

A portion of each payment you make each month is passed on to MBS investors who also receive payments from hundreds of other loans pooled together in that mortgage-backed security. Mortgage-backed securities often referred to by their acronym MBS are bonds that are secured by a mortgage or pools of mortgage loansThis type of security is also known as a mortgage-related security or a mortgage pass through. Describe how mortgage-backed securities are used.

When an investor purchased one she was purchasing the cash flows from the individual home mortgages that made up the security. Mortgage A mortgage is a loan provided by a mortgage lender. In your day to day life this would never make any difference if you know it or not.

A mortgage-backed security was made up of a bundle of home mortgages often running into the thousands that had been packaged together into a tradable asset. Many observers fault security ratings agencies with improperly rating mortgage-backed securities in the run-up to the Financial Crisis of 2008. Collateralized mortgage obligations CMOs are mortgage-backed securities that are segmented into classes representing the timing of payback of the principal.

A mortgage-backed security MBS is an investment similar to a bond that consists of a bundle of home loans bought from the banks that issued them. Mortgage-backed securities MBS are groups of home mortgages that are sold by the issuing banks. Mortgage backed-securities or MBSs are bonds secured by a mortgage or pools of mortgages.

Describe how Mortgage-Backed Securities MBS were used throughout the Credit Crisis and compare their use then to their use today. Explain the use of a. Mortgage-backed securities consist of a group of mortgages that have been structured or securitized to pay out interest like a bond.

Mortgage-backed securities are securities whose values are backed using mortgage loans. In the United States there are three sectors for securities backed by residential mortgages. The emergence of subprime loans and the demand for subprime loans caused the creation of new financial products.

The Advantages Of Agency Mortgage Backed Securities Western Asset

Mortgage Backed Security Mbs Definition Example

:max_bytes(150000):strip_icc()/dotdash_Final_Why_do_MBS_mortgage-backed_securities_still_exist_if_they_created_so_much_trouble_in_2008_Apr_2020-01-fb17668872fd483781eef521a1ddbde8.jpg)

Why Do Mbs Mortgage Backed Securities Still Exist If They Created So Much Trouble In 2008

Comments

Post a Comment